Blogs

Read our latest news and industry insights.

Geo Botha

28 February marks the end of the tax year. If you have some extra funds available, this might be the perfect time to consider adding to your savings in a retirement annuity (RA) or tax-free savings account (TFSA), thereby enjoying the significant tax benefits these products offer. Below are the benefits of both an RA and a TFSA, as summarised by our partners at Ninety-One. As always, please contact your personal financial adviser to assist you in calculating the amount you can still contribute, as well as whether this will be best for your portfolio and personal situation: Why invest in an RA? 1. RAs can be viewed as gifts from the taxman. For example, at a 45% marginal tax rate, a deductible RA contribution of R100 000 can generate up to R45 000 in tax relief (within the limits). Tax will be applicable when the funds eventually pay out at retirement, but due to the tax-exempt portion of the lump sum, as well as the tax rebates for individuals over 65 and 75, you may pay less tax at that time. 2. You do not lose your tax benefits, even if you contribute more than the maximum annual tax deduction (excess contributions) If you contribute more than the maximum (excess contributions), your tax benefit will roll over to the next tax year of assessment. Any excess contributions in subsequent tax years will continue to be rolled over. This means that you could receive a tax benefit at retirement, after retirement, or your beneficiaries could benefit when you have passed away, as explained below. RA contributions and tax Before retirement When contributing to an RA, your maximum tax deduction for the year is the lesser of: R350 000 27.5% of the higher of remuneration or taxable income Taxable income excluding taxable capital gains At retirement If you elect to receive a lump sum: The remaining excess contributions will be paid out free of tax R550 000 could be tax-free – if not previously utilised After retirement Excess contributions remaining after your retirement are deductible from your compulsory annuity income for tax purposes (section 10C of the Income Tax Act). After you pass away If your beneficiary elects to receive the full death benefit, or a portion thereof, as a lump sum: The remaining excess contributions will be paid out free of tax R550 000 could be tax-free – if not previously utilised The tax deduction limit applies to the combined total of RA contributions and all member and employer contributions to workplace pension and provident funds. 3. You enjoy estate-planning benefits. An RA is exempt from estate duty. Please note that excess contributions may be included for estate duty purposes, to the extent that a lump sum is received. The growth on your excess contributions is not subject to estate duty – you can therefore effectively peg the value of your estate (similar to the benefit obtained from a trust, prior to the introduction of section 7C of the Income Tax Act). Over time, the value of excess contributions could be reduced, which would decrease the potential estate duty payable on these excess contributions. 4. No tax is deducted within the investment (no income tax, capital gains tax or dividend withholding tax). This means you will benefit even more from compounded growth. 5. You remain disciplined with your retirement savings. The two-pot retirement regime was introduced on 1 September 2024. This system allows members access to a small portion of their retirement savings before they retire, while preserving the remainder until retirement (unless one of the exceptions specified in the Income Tax Act applies). To achieve this, various notional components within a member’s retirement fund benefit or contract were created. These components are referred to as: The Vested Component The Savings Component The Retirement Component Members are able to withdraw from the Savings component once in a tax year. Withdrawals from the Savings component are subject to a minimum of R2 000 per withdrawal and are taxed at your marginal tax rate. 6. You have protection from creditors. This means your savings for your retirement will be available when you need them. Key considerations when investing in an RA RAs are subject to Regulation 28 investment limits. On the death of the investor, the Board of Trustees will have full discretion when deciding on a fair allocation of the benefit to dependants and/or nominees, in terms of section 37C of the Pension Funds Act. There are liquidity restrictions prior to reaching retirement age. This means that you will only have access to the funds in the Savings component before reaching the age of 55 (unless you qualify for one of the exceptions). Why invest in a TFSA? TFSAs are exempt from tax on interest, dividends and capital gains. There are no restrictions on withdrawals; however, if you replenish the funds withdrawn, this will count towards your annual and lifetime contribution limits. For this reason, these investments are generally more suited to long-term investing. TFSAs are a great way to save for your child’s education (be aware of donations tax if the annual exemption of R100 000 per donor is exceeded). Contributions No matter how many TFSAs you have with different product providers, the total combined value of your contributions may not exceed R36 000 per tax year and R500 000 over your lifetime. If you exceed these contribution limits, a penalty of 40% will apply on the amount contributed above the limit, which will be added to your tax assessment.

I recently signed up for one of my bucket list items, the demanding Comrades Marathon. It’s something that I always had in the back of my mind, and I said to myself that if I ever where to take on the 87km beast, I am going to be prepared. So, as I successfully entered and received my number, I immediately did 2 things: 1) I got a coach: Someone who is experience and can guide me week by week, month by month leading up to the Ultra Marathon 2) I got a training partner : After using all my persuasion skills, I convinced a friend to join me on this journey. Not only for the comradery, but more as an accountability partner, to make sure I show up for training even though I might not feel like it For many of us, we want to make sure 2026 is our best year yet, not just physically, but financially as well. How can we be more productive and make more money or at least manage it better? In his Book Atomic Habit, James clear writes about the ‘Commitment device’ in chapter 14. A Commitment device, also referred to as the ‘ Ulysses pact’ is a choice you make in the present, that controls your actions in the future. It is a way to lock in future behaviour, bind you to good habits and restrict you from the bad ones. Some examples include: - Eating out of smaller plates – to limit calorie intake. - Unsubscribe to emails and apps – to waste less time - Setting up an outlet timer, to cut off the Wi-Fi at 9pm per night - to limit social media or series binging. - Keep your phone in another room when working – to avoid distractions When it comes to your finances here are a couple of things you can try to make 2026 you most financially rewarding year yet. - Automate your investments: Remove the temptation to spend your money by setting up debit order for the money to be invested as soon as it hits your bank account - Appoint a financial partner – this can be an advisor, friend or spouse: his person must be strict and diligent and keep you to your goals. Schedule quarterly calls to go through your investment accounts to see how much it has grown - Buy groceries only twice a week: We almost always buy things we don’t need – limit your number of visits to the store - Let you partner hide your credit card during the week and have an x amount of cash available. This might sound harsh but can be extremely effective as we swipe or tab often without thinking. There’s so many examples of how we can adjust our behaviour by setting up ‘ Commitment devices. I’d like to hear your favourites so please send them through to geo@bovest.co.za and let’s help each other to make 2026 memorable and profitable. Geo Botha CFP® Marketing Director

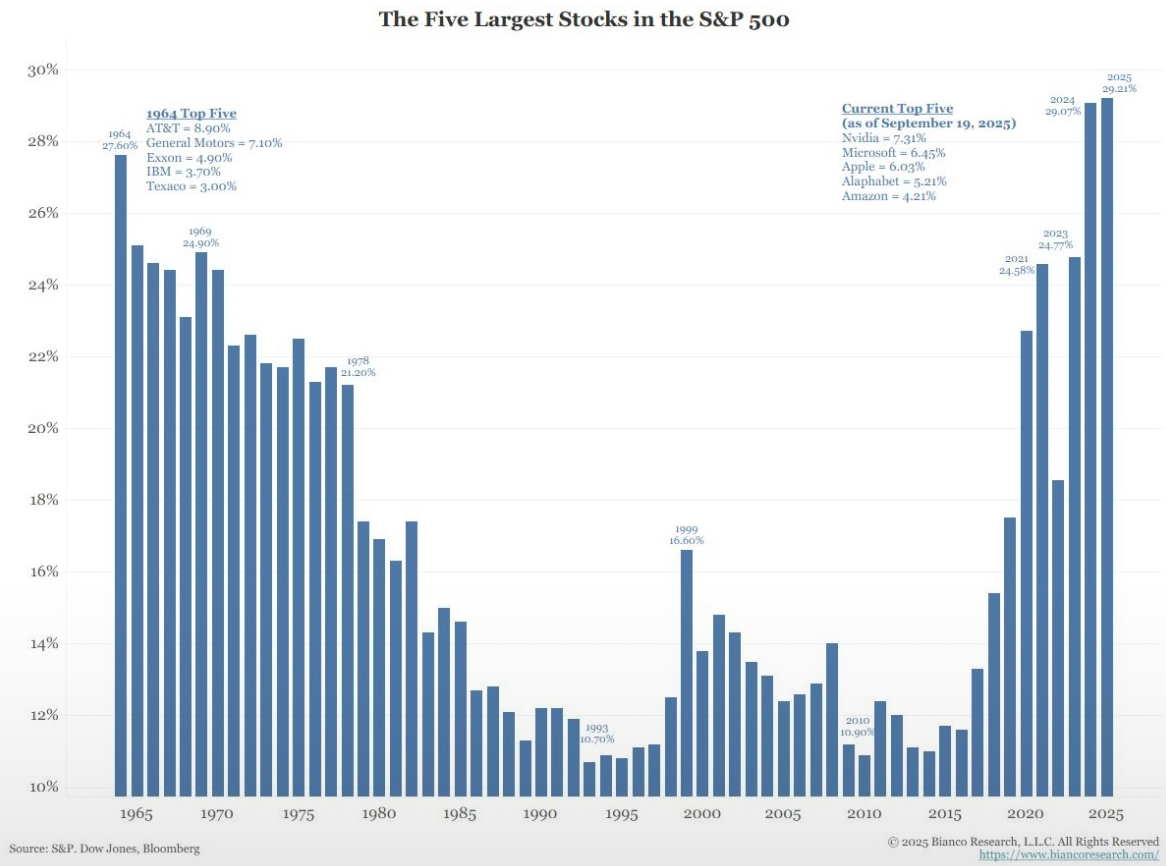

In this month’s chart we can see that over the last 60 years, top five stocks now make up nearly 35% of the US market — the highest concentration on record. They include: Nvidia, Microsoft, Apple , Alphabet (Google) and Amazon. Market leadership is becoming increasingly narrow, leaving investors more exposed if these giants stumble. At Bovest we take this into consideration when constructing our client’s portfolios and it serves as a reminder of the risks of concentration and the value of diversification. Although almost every investor will have exposure to these large tech companies in one way or another, it is important to limit the level of exposure and not get caught into investing in themes or falling in love with a certain stock. At a recent event, hosted by pour partners at Ninety-One asset managers, many of the talks still revolved around the impact of AI, not only in the workplace, but investment opportunities as well. This boasts the idea that these stock might still have room to grow, but at a certain point valuations move across the tipping point, and we will see a correction in prices. Kindly contact our team if you have any questions.

How to invest in a volatile market: 3 Principles to keep in mind ‘In the short term, markets can be very volatile depending on which news story makes headlines. However, over the longer-term investors are always rewarded for staying invested and riding out the waves.’ We know this by now, we have heard it many times before and historical data proves it. Yet it’s easier said than done. When it gets to our own money we are emotionally involved and there is a part of us that believes that this time, it might indeed be different. What if the markets never recover and I suffer permanent capital loss. And with the increase power of AI and social media, it feels like my portfolio hangs on the thread of a single Tweet. In this article Stephen Bernard, an actuarial analyst form our partner Allan Gray share his views, backed by statistics and historical evidence: Read the article here: https://www.allangray.co.za/latest-insights/markets-and-economy/how-to-invest-in-a-volatile-market/

As of from September last year we have seen a change in regulations and the new: “2 Post system” was implemented across all retirement products, whether you belong to a Pension fund, Provident fund, or Retirement annuity. The creation of the 2 new pots, essentially leaves you now with 3 Potts: The Vested Pott: This was the balance of you accumulated fund up until September 2024. This Pott will still be governed as per the old rules of the specific product. The Savings (Emergency) Pot: With a once boost of 10% (up to a Max of R30 000) of your vested pot. The Savings pot is open for you to make one withdrawal per annum. One Third off all your contributions from September 2024 will go into this pot. Very important to note that if you withdraw from this pot, you will be taxed at your marginal income tax rate immediately, whereafter the balance will be transferred to you The retirement Pot: The other two thirds of your retirement contributions from September 2024 will go into this pot. This money cannot be accessed before retirement and an annuity will have to be bought after retirement As of January 31, 2025, the South African Revenue Service (SARS) reported that R43.42 billion had been paid out from the two-pot retirement system's savings pot. This involved 2.4 million applications for tax directives, with 2.4 million directives approved. The remaining applications were declined due to various reasons, including incorrect identification or tax numbers. It is very important to take the long-term effect of any action you take into consideration, and this is where a financial advisor can really add value: To minimise you tax liability and to ensure you have peace of mind in the years leading up to retirement and the years in retirement. Different options are available once retired: Life Annuity Vs. Living Annuity, each with its pros and cons and careful considerations and comparisons should be made before deciding on a retirement product. Kindly contact us for any questions or comments at admin@bovest.co.za Geo Botha CFP® Director and Wealth Manager

March this year marked exactly 10 years since I joined Bovest back in 2015. After completing my B.com and honours degree, I first gained experience in the corporate world in Sandton, Johannesburg, before I joined our independent wealth management firm. Throughout the last 10 years I had the opportunity to work with people from all walks of life and from every interaction I learned something. Some inspired me and others deterred me. It’s a difficult task to summarise them, but here are 10 money lessons I’ve learned over the past 10 years: Money will not solve all your problems. On one specific morning I arrived at work at around 7am. The cleaning lady, who was whistling and singing greeted me politely while mopping the floor and going around her business. 30 minutes later we had a meeting with one of our wealthiest clients who was completely stressed out and upset about something his business partner did. The vast contract of the two people’s Net worth and state of mind was a reminder that money will not solve all your problem, neither will money alone make you happy. Having money does not make you a better person. I see it often, people who have a large amount of wealth, who has a prominent position at work or runs a successful company might often has an aura of importance around them. They will think their opinion carries more weight and that somehow the universal laws do not apply to them as strictly as the ‘normal’ person. Money is NOT the root of all evil In contrast to the above 2 points, I see many wealthy people doing incredible noble things with their money. They provide food for the less fortunate, put children through college, create job opportunities for others 7 make the world a better place in various other ways. Without money this will not be possible. Having ambition does not make you materialistic. Talking about money, wanting to increase your income, or working hard to get promoted does not make you materialistic or egocentric. As humans we need to grow and aspire to be better that we were yesterday. It gives us purpose and direction. Money is on of the topics most often discussed in the Bible and making the best of your God-given talents is something we all should work towards. Don’t think small, because it makes others feel uncomfortable, we only have one shot in life. Tax planning plays a much bigger roles in investments than you think. I don’t know one single person who is happy to pay more taxes than he or she should, yet we often overlook the opportunities where we can minimise our tax payable. Paying less income tax is important, but for most parts out of our control, it’s saving tax on the growth and payouts of our investment where the big opportunities hide. Simple habits almost always guarantee success. Successful people are very good at focussing on their field of expertise, where they make their money and then outsourcing the rest. They don’t overcomplicate their finances, by trying to pick every hot stock or coin that is trending. They realise that automating their finances is incredibly powerful and treat their monthly investments like an expense, it automatically gets deducted from their bank account and they don’t need to waste their decision-making power on it. Compound interest cannot be overstated enough. We have all heard wonderful quotes about the power of compound interest and how your money can work for you. Yet most of us still lack the discipline and patience to allow it to work wonders in our portfolios. In every meeting I have with people close to retirement, who have given time the attention, they are in awe of how their money has grown in the latter part of their investment journey. We all are part of the ‘Money Game’ whether you want to play or not. If you bought something in the last 2 days, you are part of the economy, the money game. Money does not need to rule your every though, but ignorance is not bliss. Thinking that it’s noble to never talk about money or to think you don’t need money, will have serious consequences. In contrast, having a lot of money doesn’t mean you are winning at the game of money: If money is more important than your relationships, you’re not winning. If money influences your ethics, you are not winning. If your health is suffering in your pursuit of chasing money, you are not winning. Take control over your financial situation and not the other way around. Be aware of the ‘Lifestyle Creep’ Sometimes also called the “bracket creep” Throughout life you are bound to gradually earn more as the years go by, however the silent killer, less talked about side of the equation is the growth of our expenses. This often happens in small increments and without us realising it: You buy slightly more expensive gifts for your children, you drink more expensive wine, you go out to restaurants more often or you upgrade your brand of make-up or gadgets are home. While none of these are bad in principle, it is worth paying attention to them and invest, before you spend on you ‘Nice to haves’ Enjoy your money. This is probably the most simple and important lesson, but one that’s not easy to obtain. It’s only once you’ve mastered many other aspects of money and your mindset around finances that you can really enjoy your money in a guilt free manner that’s not guided by outside influences. Know yourself, know what will bring you joy, work hard, give to others and enjoy your money.

March marks the start of the new Financial Year. It gives us a time to reset and evaluate the first 2 months of 2025. January and February are historically the 2 busiest months in the financial industry as clients set to get their finances in order and minimise their tax burden, mostly via Retirement annuities and Tax-Free savings. March now gives us the opportunity to start with a clean slate, to re-assess our new year's resolutions: What work and what didn’t. It’s a chance to not only set new goals but to create the right habits and systems. Over the decades so many get rich quick schemes ruined so many lives. Looking backwards it's easy to see that it was a fraudulent scheme, yet in the present, many people still get caught. We lack the discipline and patience. There are essentially 5 ingredients to guaranteed wealth creation: How early you start How much you invest The returns of the market How long you stay invested for & The withdrawals you make. 4 of these are entirely within our control, and we have more power than we think. However, it's when we try and speed up the system that things go wrong. Look after your money, don't just trust anyone and if it promises above 10% guaranteed return, be very careful. We will share more on this topic in one of our Podcast episodes, coming soon..

"I'm never doing this again" This is what I said last Saturday afternoon as we started to climb the last 5 hills in the last 30 of the 200km cycle race called the Double Century. It was the 3rd time I have said it, in 3 consecutive years Only to come back and compete again the next year. Challenging ourselves physically is about a lot more than just pushing to what we think our physical limits are. It's about creating the discipline to train, the perseverance to push through and silencing those inner voices when you want to quit. It's also strange how we quickly forget about the pain and suffering and only remember the positive accomplishment and memories. I’d like to share an article I recently read from Siobhan Simpson, Head of SA Unit Trusts at Ninety one, who shared a similar experience this year. She went through the exciting yet uncertain phase of giving birth to her daughter and shared the lessons she learned throughout and how we can apply these insights into managing our own investment portfolio. She also shares some interesting stats on how investing over different time periods can greatly influence the outcome and why it’s never a good idea to wait for the right moments Read the article here Enjoy the festive season with your loved ones and stay safe out there. Geo Botha Marketing Director