By Ruvan Grobler

•

January 22, 2026

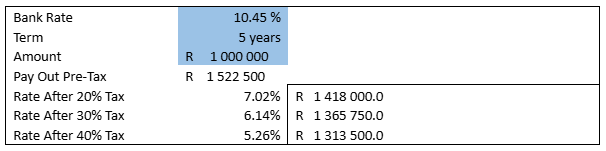

Medicine is built on precision, protocols, and evidence-based decisions. Financial life, unfortunately, is not. For many doctors, success arrives early in one area of life and much later in others—time, structure, and strategic planning often lag behind income. Over the years, a few patterns come up repeatedly when working with medical professionals. These are not mistakes born from ignorance or carelessness, but rather from being busy, successful, and focused on patients first. Here are five of the most common financial missteps doctors make—and why addressing them early can materially change long-term outcomes. 1. Being “Cash Heavy” Feels Safe… Until It Isn’t Holding large cash balances is often seen as prudent. Cash is liquid, familiar, and low-stress. For doctors with volatile workloads or private practices, this feels especially comforting. The problem? Cash is one of the most tax-inefficient assets for high earners. While interest income enjoys a modest annual exemption, anything above that threshold is taxed at your marginal rate. For many doctors, this means a significant portion of “safe” interest returns never actually reach them. Add inflation into the mix, and the real (after-tax, after-inflation) return on excess cash can quietly turn negative. Cash has a role—but without intention and limits, it often becomes a silent drag on long-term wealth. 2. Paying More Tax Than Necessary (Without Realising It) Doctors are among the most heavily taxed professionals in South Africa, yet tax planning is often treated as a once-a-year exercise rather than an integrated strategy. The issue isn’t usually under-reporting—it’s under-structuring. Different investment vehicles are taxed in very different ways. Income tax, capital gains tax, and dividend tax don’t just affect returns; they compound over time. Two portfolios with the same gross return can end up worlds apart after tax if they’re structured differently. When investment decisions are made in isolation—without considering tax, time horizon, and estate implications—the cost isn’t obvious in year one. It shows up quietly over decades. 3. Offshore Exposure: Opportunity or Overreaction? Global diversification is important. Offshore exposure can reduce concentration risk and unlock opportunities unavailable locally. However, many investors move money offshore without a clear strategy—often driven by headlines, fear, or currency anxiety rather than long-term planning. Key questions are frequently overlooked: How much offshore exposure is appropriate for your situation? Which structures are most efficient? How does this affect tax, liquidity, and future repatriation? Offshore investing isn’t a binary decision. The value lies in how, where, and through what structure exposure is obtained—not simply in moving money abroad. 4. Paying Everyone Else First Doctors are natural caregivers. Practices, staff, patients, families—everyone’s needs come first. Personal savings often come last. The data is clear: South Africa’s domestic savings rate remains worryingly low. Even among high earners, inconsistent or delayed personal investing is common. The risk isn’t lifestyle inflation—it’s time. Missed early contributions can’t be recovered later, no matter how high income becomes. Compounding rewards consistency, not intention. Paying yourself first isn’t about sacrifice; it’s about ensuring today’s success translates into future independence. 5. Using the Wrong Investment Structures This is arguably the most expensive mistake—and the least visible. Many doctors accumulate investments across multiple platforms, policies, and accounts over time. Each decision may have made sense in isolation, but together they can create inefficiencies around: Tax Access Estate planning Intergenerational transfer The structure holding the investment often matters as much as the investment itself. Over a 20- or 30-year horizon, the difference between “adequate” and “optimal” structuring can be substantial—even if the underlying returns are identical. The Common Thread None of these mistakes stem from poor decision-making. They stem from complexity, time pressure, and the reality that financial planning is a discipline of integration—not isolated choices. Income, tax, investments, offshore exposure, and estate planning don’t operate independently. When aligned, they reinforce one another. When they’re not, value leaks out quietly year after year. For professionals who spend their lives mastering complexity in one field, the challenge is recognising that financial clarity often requires the same level of specialised thinking. Because in finance—just like in medicine—the biggest risks are rarely the obvious ones. Ruvan J Grobler RFP™ (PGDip Financial Planning)